Indiana Casino Tax Revenue

Posted : admin On 4/2/2022INDIANAPOLIS — Caesars Entertainment will have another year to sell its northwestern Indiana casino as required by state. Which generate between 50% and 60% of state casino tax revenue.

Ohio Casino Tax Revenue

- Caesars Entertainment will have another year to sell its northwestern Indiana casino as required by state officials. Which generate between 50% and 60% of state casino tax revenue.

- For example, if Indiana Casino Tax Revenue you deposit €100 and receive a €500 bonus, then Indiana Casino Tax Revenue you have to wager €600. 40 = €24 000 before you can make a withdraw. Add a maximum withdraw limit to this and your chances to win big are severely decreased.

So you’ve won a jackpot on the slots or defied the odds on a sports bet in Indiana. Other than bragging on social media, one of the next things you have to do is give the federal and state governments their cut.

Winnings from all forms of gambling are taxable income, including winnings from:

- Lottery

- Slots

- Table games

- Sports betting

- Horse racing

Even if you put money down and win an organized Rock-Paper-Scissors competition, you have to pay taxes on the winnings. Even non-cash prizes like merchandise have to be reported on your federal and state income tax returns.

The idea that the Internal Revenue Service and the Indiana Department of Revenue won’t know is folly. The parties which pay out the prizes, whether that be casinos, sportsbooks, whatever, keep receipts and report them.

How much are my gambling winnings taxed in Indiana?

Effective for tax years after 2017, the federal rate on winnings over $5,000 is 24%. Winnings under that benchmark of $5,000 must also be reported depending on their amounts and sources.

Currently, Indiana’s personal income tax rate is 3.23%. Almost all gambling winnings are subject to this tax.

Casinos typically withhold 25% of your winnings for tax purposes. That is only the norm if you provide them with your social security number, however. If you decline that option, they usually withhold 28%.

How to determine if your winnings are taxable income

Another service the casinos usually provide for mutual benefit is sending you the appropriate paperwork. Fortunately, Indiana allows you to fill out the same form for both purposes.

Form W-2G, Certain Gambling Winnings reports your winnings for the year to both the IRS and you, in case you haven’t been keeping track.

The amount on this form will include any winnings from the year which qualify for federal taxes. That total will consist of:

- Your winnings (not reduced by the wager) of at least $1,200 from a bingo game or slot machine

- The winnings (reduced by the wager) of at least $1,500 from a keno game

- Your winnings (reduced by the wager or buy-in) of at least $5,000 from a poker tournament

- The winnings (except winnings from bingo, slot machines, keno, and poker tournaments) reduced, at the option of the payer, by the wager are $600 or more, and at least 300 times the amount of the bet

- Your winnings that are subject to federal income tax withholding (either regular gambling withholding or backup withholding)

How to report your gambling winnings to the IRS

The IRS requires you to report the total of your all qualifying gambling winnings for the year on a Form 1040. If you get the W-2G from the payers of your winnings, it’s a simple process of adding up those winnings and the amount of tax they withheld and then transferring those totals onto the 1040.

Add up all the numbers from Box 1 on the W-2G forms and separately, calculate the sum of all the numbers from Box 2. Place the Box 1 total on line 21 of the 1040 and place the Box 2 sum on the line designated as federal income tax withheld.

Even if the game operator didn’t do its job and you didn’t receive a W-2G, that doesn’t mean you’re off the hook.

You are still required to report all your gambling winnings from the year on the form 1040. To do that, fill out Schedule 1 with your gambling winnings as “Other Income.” Attach that to Form 1040 and include it in your personal income tax return.

So what if you weren’t flying solo, but pooled your resources together with others to maximize your chances of winning it big? That doesn’t change much.

Paying taxes on a shared prize

The IRS is prepared for this scenario. Form 5754is your go-to.

This is the form to use when you receive gambling winnings, not in your name on a W-2G. This form is also appropriate when you’re part of a group of two or more people sharing winnings.

The important thing to remember is that Form 5754 should not be included in your income tax return. Fill it out and give it to the person who received the W-2G.

Keep a copy for your records. The person who received the initial W-2G should submit all the appropriate 5754s back to the casino so they can correctly record the transaction.

The casino will then send each person their own W-2G. From there, the process is identical to how you would report any individual winnings.

How to report your gambling winnings to Indiana

As previously stated, Indiana is a state that allows you to use Form W-2G for your state income tax return as well. To do so, transfer the amount from Line 7 of your Federal 1040 to Line 1 of your IT-40.

If all or part of your winnings came while you were outside of the Hoosier State, you still must report them. That includes winnings from multistate lotteries. Report them just as you would if they came from an in-state game.

There is one legal way to reduce your tax liability from gambling winnings. It only applies if you opt to itemize your deductions, however.

Oklahoma Casino Revenue

Indiana and IRS gambling deductions for taxes

The IRS does allow a deduction for gambling losses. It cannot be claimed if you take the standard deduction on your return, however.

For those who itemize, gambling losses go on Line 28 of Schedule A, Form 1040. You cannot claim a deduction larger than your reported winnings.

Casino Revenue By State

And just because you deposit more than you withdraw from your bank account is not necessarily sufficient evidence. You must prove your losses.

You also cannot deduct expenses incurred along the way. The cost of your hotel and meals are just part of the necessary out-of-pocket expense.

If you opt to itemize and claim gambling losses, you’re better off keeping the following for your records:

- The date and type of each wager

- Where you placed the bet, i.e., the name of the casino

- How much you won or lost

- Wagering tickets

- Canceled checks

- Credit card records

Casinos can make this easy for you as well. If you’re part of their rewards programs, getting an annual summary of your gambling losses is quite simple.

The same goes for any winnings from the latest gambling option, legal sports betting in Indiana.

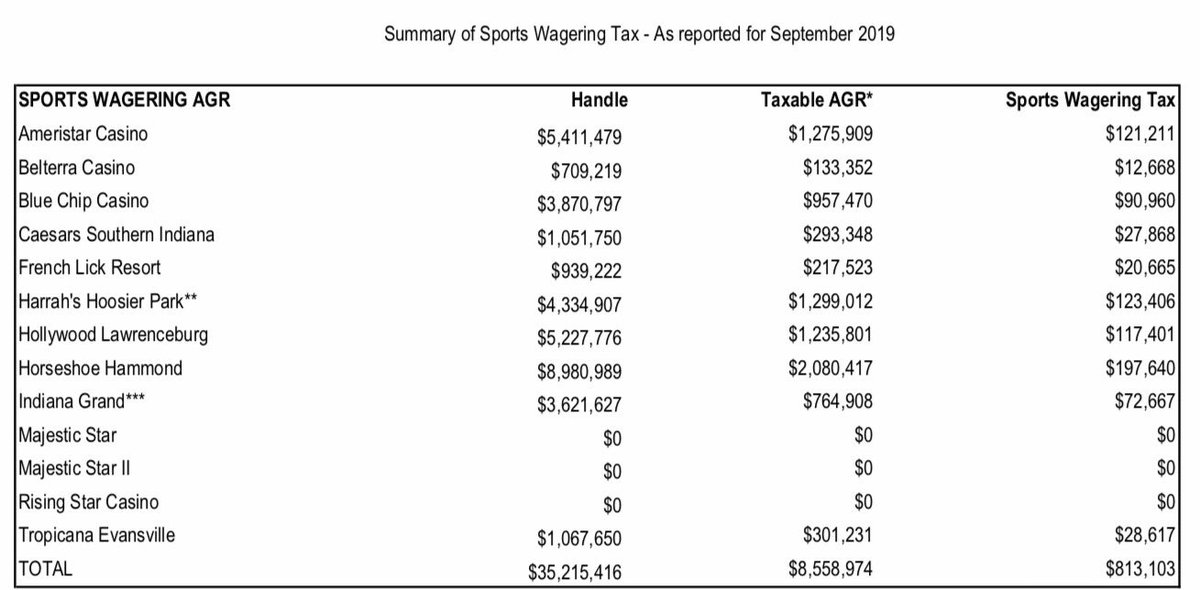

Taxes on sports betting winnings

With legal sports betting new to Indiana, there are plenty of people betting on college football and the NFL. Your parlay on Notre Dame football or Purdue football games is also taxable income if it exceeds $600. It doesn’t matter whether you placed your wager at an Indiana online sportsbook, inside a casino, on a kiosk at an off-track betting site or on your phone from your couch.

Just like other types of gaming operators, the book you placed your bet with should send you a W-2G. You can use that to report your winnings and withholdings to both Indiana and the IRS.

The positive side of that is just like any other gambling losses; the money you lose betting on sports can be deductible if you choose to itemize. Just as with any other deductions you claim, keeping detailed records is essential.

With any money that is deemed income by the IRS, it’s important to know what your specific tax bracket is to avoid underpayment. The highest federal tax rate is currently 35%, and that’s in addition to the 3.23% you would owe the state on your sports betting winnings.

As most operators only withhold 25% of winnings automatically, you may owe additional federal tax above and beyond what the operator withheld based on your personal income. That amount would be due upon filing.

That applies equally to those who play casino games in person and online in the Hoosier State.

Taxes on online casino games and online poker

While online poker and online casinos have yet to be legalized, when they do, taxes will work the same as they do at land-based casinos.

Ohio Casino Tax Revenues

The operators of the games should send you a W-2G summing up all your winnings from the year once they reach certain thresholds depending on the type of game. Those are:

- Your winnings (not reduced by the wager) of at least $1,200 from a bingo game or slot machine

- The winnings (reduced by the wager) of at least $1,500 from a keno game

- Your winnings (reduced by the wager or buy-in) of at least $5,000 from a poker tournament

- The winnings (except winnings from bingo, slot machines, keno, and poker tournaments) reduced, at the option of the payer, by the wager are $600 or more, and at least 300 times the amount of the bet

- Your winnings are subject to federal income tax withholding (either regular gambling withholding or backup withholding)

With the W-2G in hand, you have what you need to report your winnings and pay any applicable taxes to both the state of Indiana and the IRS. Let’s review all the pertinent information that is relevant regardless of where your winnings came from:

Indiana Revenue Department

- The gaming operator you placed your wagers with should send you a W-2G

- You can use the W-2G to report your winnings on both your federal and state taxes

- How much federal tax you pay depends on your personal income

- The Indiana rate is 3.23%

- If you don’t get a W-2G, you still have to claim your winnings as income if they qualify

- You can deduct your losses on your federal return, but you must itemize

- If you do go that route, keep any and all records from the transactions

With those simple things in mind, you too can stay safe from tax fraud while gaming in Indiana. Enjoy the games!